property tax advisor uk

From 1 April 2021 The. Property Tax Advisers - Property Tax Advisers.

London 44 020 7240 9971.

. We work with you to increase your knowledge all the time. Talk to one of our tax experts today for tailored advice depending on your needs. We are specialist taxation consultants and business advisors exclusively for landlords and property investors in the UK.

There are new names in the prestigious Spears top tens of both the tax and trust lawyers and tax accountants after a year in which the finest financial minds battled Brexit a snap election and. Find and compare the best companies in Tax advisor on Trustpilot and add your own experience. The tax years are different in the US than they are in the UK.

Tax Advisory UK can help you with all your tax planning tax investigations and tax advice offering the best client service available in the industry. As a busy landlord you know that time is money and UK property. Capital Gains Tax CGT Featured Adviser.

We ask clients to complete the meeting form with as much details as possible so that all the. Stress free Business Accounts and Tax Return Service from tax specialistsTaxAdvisor UK. Our goal is simple to.

By providing guidance on the most appropriate ownership structure Paul helps. Up to 30 minutes of telephone tax advice on any aspect of UK taxation for as little as 97 with our own UK tax guru Arthur Weller. Personal UK Expat Tax Advice Expat Tax Rules - Alliotts Chartered Accountants.

For businesses Categories Blog. We plan the most tax-efficient way of tax savings for your company. I am an experienced Chartered Tax Adviser offering a virtual Tax Partner service to.

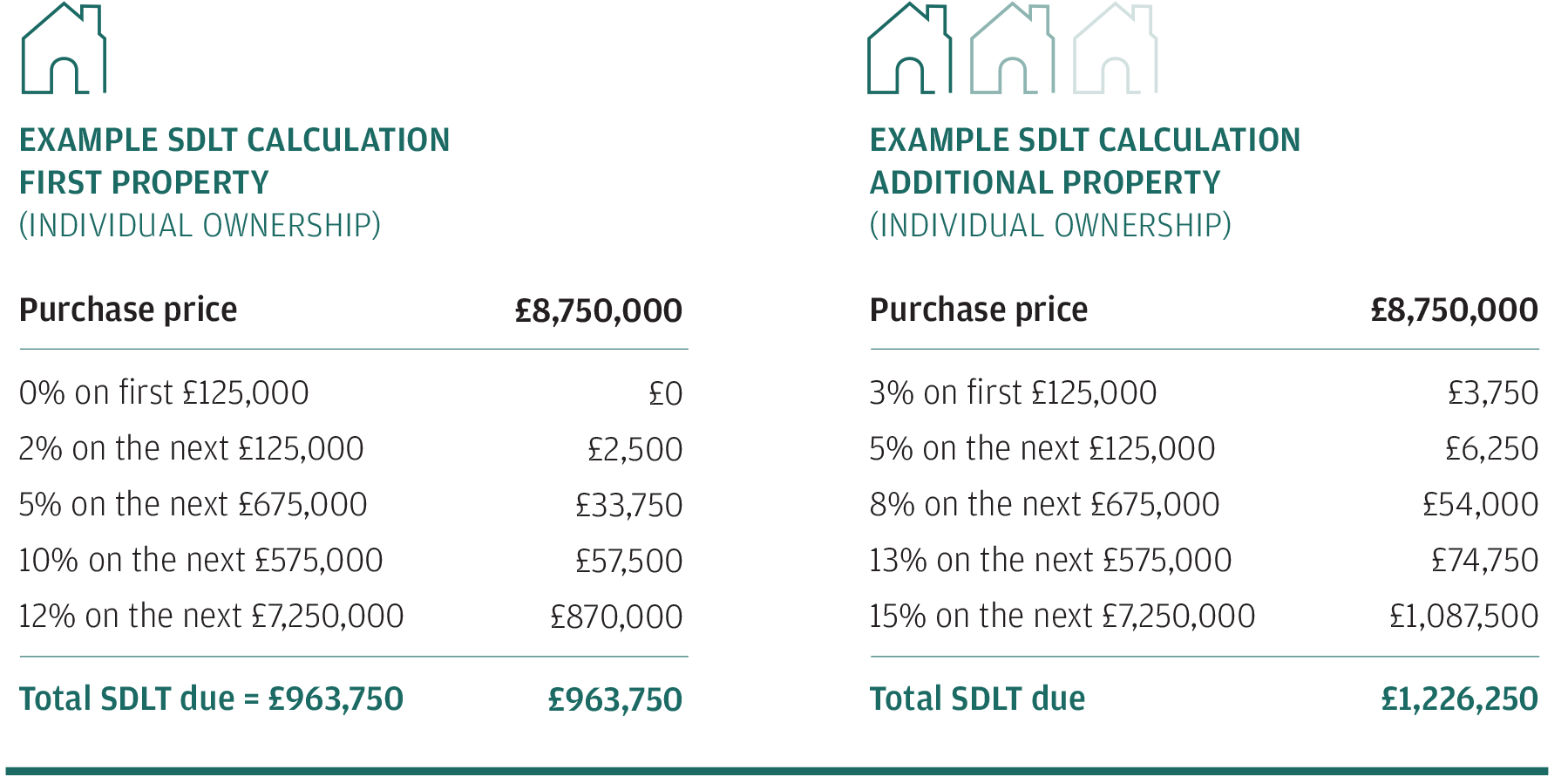

The IRS American tax system uses a calendar basis from the 1st of January or if you are an American reading this January 1 to. The current Stamp Duty Land Tax threshold for residential properties is 500000 up to 31 March 2021. One of our methods is the Bitesize Tax Advice series so youre in control on Property Tax matters we.

Landlords can book time with our property tax specialist right from the comfort of their homes. Excluding your personal allowance income received up to 37700 will be subject to a tax rate of 20. In that time he has gained an in-depth knowledge of the commercial and residential property market.

For non-residential land and properties the threshold is 150000. If you incorporate the personal allowance this means that you will. Categories Blog For businesses.

UK Tax Specialist and Property Taxation Advisor.

Simple Tax Guide For American Expats In The Uk

Property Accountants Property Accounts Property Tax Advice

Uk Property Accountants Reviews 2022 Trustindex Io

Importance Of A Specialist Property Tax Adviser Call Accountants Uk

Property Tax Capital Gains Tax Taxqube Chartered Accountants Tax Advisers Landlord Tax

Smisiewicz Smisiewicz2 Profile Pinterest

6 Reasons Why Landlords Should Hire A Property Accountant Wright Vigar

3 Ways To Financially Optimize Your Landlordship Property Tax Advice London Simply Tax Advisory

Buying Residential Property In The Uk J P Morgan Private Bank

Cloud Accountants In Manchester Chartered Accountants Uk Mmr Accountant

Riverview Family Our Associated Tax Specialist Businesses

Property Tax Advice Auction Essentials Access Market Leading Professionals

Property Accountants Tax On Rental Income Get Help At Property Tax Advice

232 6 Top Tax Tips With Sean The Property Tax Accountant Youtube

Super Financial Limited Property Accountants And Property Tax Advice

Raju Gajurel Managing Partner Uk Property Accountants Uk Property Tax Specialists Linkedin